A new diagnosis of Alzheimer’s disease or another dementia-related disorder brings with it a great deal of emotion and much uncertainty about the future. Finding ways to gain control of what can seem like a very uncontrollable life situation can provide some level of comfort. One such area, for which it can provide emotional relief to put affairs in order, but that it is essential to do so as soon as possible upon diagnosis, is with respect to legal and financial planning for the future.

As a caregiver of a loved one with dementia, you can be instrumental in encouraging your loved one to begin the planning process in the area of legal and financial affairs. Depending on the stage of disease progression, the person with dementia can and should be a part of this process at a level complementary to their abilities.

It is also important to you as a caregiver to ensure that the affairs of your loved one are in order as soon as possible after an initial diagnosis. The impact to you can be significant if pre-planning has not been done. According to the Alzheimer’s Association, 70% of the total lifetime cost of care for an individual living with dementia (which is estimated in total to be on average $350,000) is borne by the caregiver in the form of unpaid caregiving and living expenses such as assisted living, medicine, and food.

- Organize Financial Documents

A suggested first step to be done in partnership with your loved one is to organize and review all existing and financial documents, including but not limited to the following:

- Bank and brokerage account information and deeds

- Mortgage papers or ownership statements

- Insurance

- Medical and durable powers of attorney

- Monthly or outstanding bills

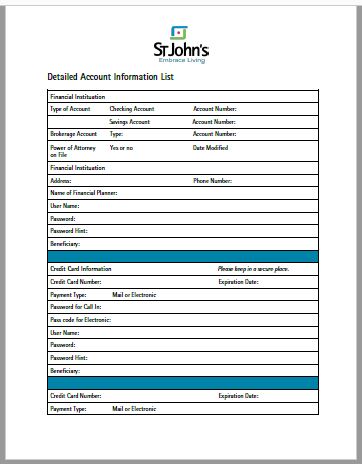

2. Create a Record of Accounts

It is also recommended that you create a record of all pertinent legal and financial account information, including online passwords, etc. St. John’s has created a template for you to record all of the important financial and legal account records in one place. This is a helpful resource for you and your loved one to complete together.

Download our Financial Paperwork Record Form.

This useful template includes space to document important account information, electronic account passwords, and a list of recommended account types to include in your financial and legal documentation process.

You may wish, with permission of your loved one, to partner together to order credit reports from multiple credit score companies (such as Experian, Equifax, or Transunion) and compare them for consistency. Consider consolidating accounts for better manageability and canceling credit cards that have not been used in the past six months.

It is important to note that you must have the power of attorney in order to manage another person’s financial accounts. This legal document can be drawn up by your loved one’s estate attorney and is often completed at the same time as a will is either created or updated to account for the impending changes expected with a dementia diagnosis. A power of attorney is typically executed when your loved one does not have the mental or physical capacity to handle financial matters and is best when there is a high degree of trust and understanding between the caregiver and his/her loved one.

3. Update Beneficiary Information

Another important step in taking care of financial matters is to ensure that you as the caregiver are listed on your loved one’s accounts and that the proper beneficiary is also listed on each asset and account.

The above recommendations are good preliminary steps to beginning the process to securing the future for your loved one and you as the caregiver. All of this can seem overwhelming on top of the emotions of a new diagnosis for your loved one.

Remember to:

Start early to develop a plan and stay the course.

Hope for the best, but plan for the worst.

Focus on the what is most important first.